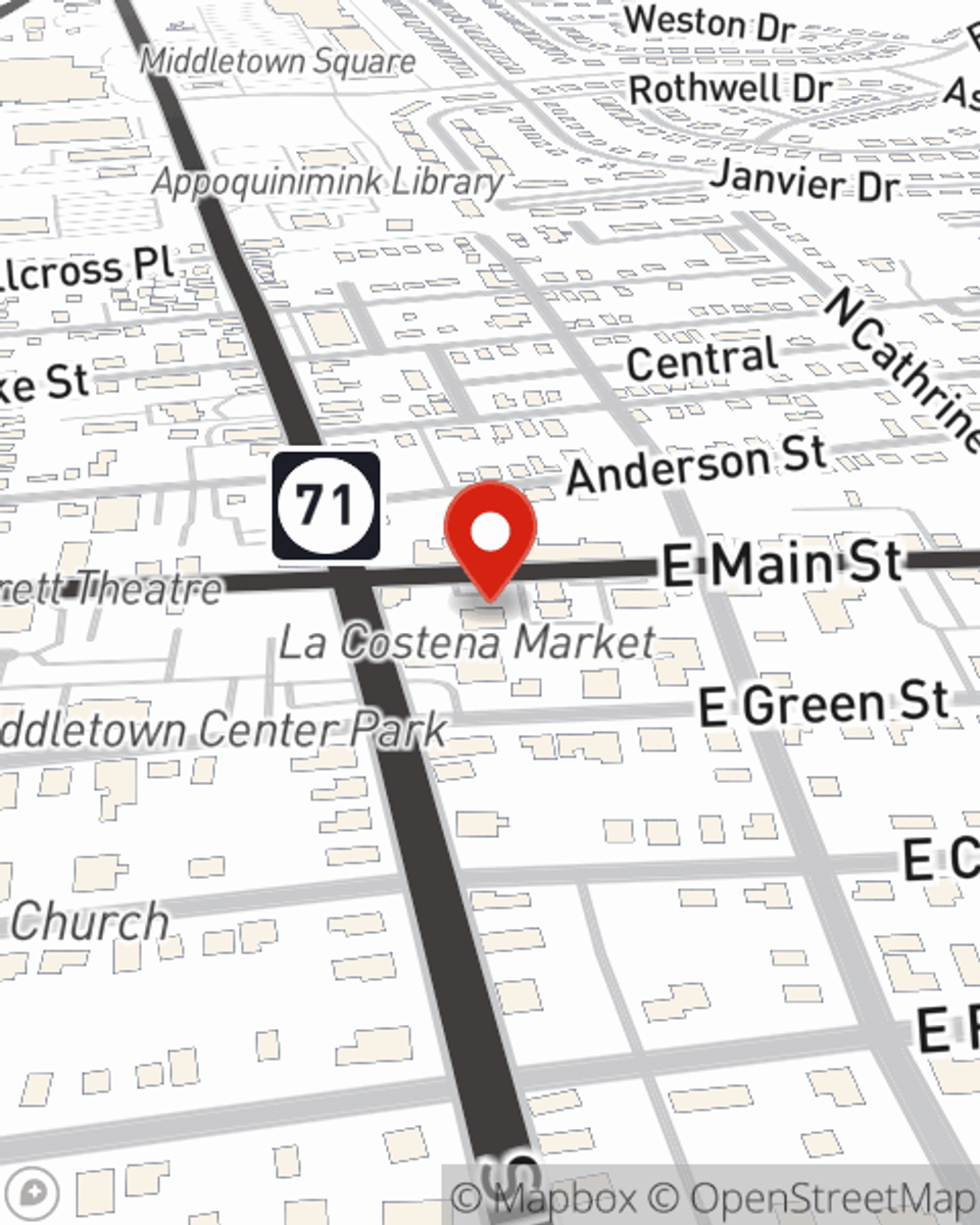

Business Insurance in and around Middletown

Middletown! Look no further for small business insurance.

No funny business here

- Delaware

- Maryland

- Pennsylvania

Cost Effective Insurance For Your Business.

Running a small business is hard work. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, contractors, trades and more!

Middletown! Look no further for small business insurance.

No funny business here

Strictly Business With State Farm

Your business is unique and faces a different set of challenges. Whether you are growing a camera store or a pottery shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your location, you may need more than just business property insurance. State Farm Agent Stefanie Wooten can help with extra liability coverage as well as employment practices liability insurance.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Stefanie Wooten is here to help you explore your options. Call or email today!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Stefanie Wooten

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.